What in the World is a Meme Stock?

An amusing or interesting item (such as a captioned picture or video) or genre item that is spread widely online especially through social media. Definition of the word Meme in the Merriam-Webster Dictionary

Since our firm’s founding in 1994, we have often written in our quarterly investment commentaries about high-quality, large capitalization stocks. We have also written frequently about growth stocks and value stocks, as well as international stocks in the developed and emerging markets. But this is the first time that we have ever used the term meme stocks. And it is probably the only time we will write about it. But the first quarter of 2021 is when meme stock became a buzz word. Thus, the main purposes of this commentary are to try to make clear what a meme stock is, how meme stocks have traded over the past year, who has prospered from or been hurt in the torrent of meme stock trading, and the similarities to the stock pools that manipulated the prices of stocks before the creation of the Securities and Exchange Commission in 1934. Finally, we make an assessment of whether serious investors should buy meme stocks.

The Definition of Meme Stock

First, a meme is something that goes viral on the internet and can make something or someone incredibly popular almost instantly. How do you pronounce the word meme? It is not entirely clear, but the proper pronunciation appears to be “meem.” But definitely not “me-me” or “mehm.” Secondly, meme stocks are not generally defined by their financial attributes such as sales growth, earnings per share, or balance sheet characteristics. Their most common features are their potential for high levels of volatility caused primarily by huge online investing communities of retail investors. The valuations of meme stocks are often based on the ability of meme stock traders to hype the stock, rather than on logic, math, and financial analysis. There is also a correlation with theme investing — for example, companies in newly fashionable industries such as cannabis, electric vehicles, space, and alternative energy sectors. And finally, pools of retail investors, using social media vehicles, have cleverly sought out companies whose stocks have a large short interest. Then these legions of retail investors have coordinated their buying of these meme stocks on social media, which, in some cases, have caused massive short squeezes, driving up stock prices tenfold or more.

The Birth of Meme Stocks

At least four contributing factors have led to the emergence of meme stocks. The first was the advent of commission-free trading of stocks and options. Introduced at companies like Robinhood, it was soon ushered in at Charles Schwab, Fidelity, and TD Ameritrade, as well as other smaller firms. Next was the ability of clients to execute trades online with their mobile devices. Another key factor was the arrival of stimulus checks pumped out in 2020 by the U.S. Treasury to millions of millennials. Unable to spend the money on travel or other pursuits due to the COVID-19 related lockdowns, they spent their money gambling on hot meme stocks. Finally, and most importantly, the rise of online investing communities has literally transformed trading on Wall Street over the past several years. An example of this is the incredible spike in the number of transactions in the stock market. One of Bradley, Foster & Sargent’s main custodians reported that the number of trades being executed by their firm during the meme stock trading craze during the first quarter of 2021 had skyrocketed to 900,000 trades per minute compared with 900,000 trades per day in same period of 2019. Social media communities on the Reddit platform have had a great deal to do with this enormous increase in trading, or what some might regard as gambling.

Reddit and Subreddits

Many investors employing traditional investment analysis of companies may not have fully grasped that there is an enormous subculture of investors who participate in social media investment communities, called subreddits. One of the best known of these communities is WallStreetBets. Its home page indicates that there are currently 9.7 million members on their subreddit (interestingly, they call their members “degenerates,” which is surely tongue-in-cheek, on their website). To understand this phenomenon, the following is a primer on Reddit, subreddits, and StockTwits. Reddit is an internet platform consisting of user-generated content, including photos, videos, links, and text-based posts. Discussions of this content are posted by members on what is basically a bulletin board website. According to Reddit, in 2019 there were approximately 430 million monthly users, who are known as “redditors.” The content on the Reddit platform is divided into categories or communities known as “subreddits,” of which there are more than 138,000 active communities. Each subreddit focuses on a specific topic. Influential subreddits focused on investing in the stock market are WallStreetBets, r/stocks and r/investing. Each subreddit has its own moderators of content on the site, and the moderators enforce specific rules for the community and even ban users from the forum. Some of these investment subreddits are known for their rough and profane language, as well as their colorful jargon and creative terms. Members are anonymous and vote about what is posted. StockTwits is another social media platform founded in 2008 and is designed for sharing ideas between investors, traders, and entrepreneurs. StockTwits currently has over two million members. What kind of person becomes a member of subreddits or subscribes to StockTwits? According to various sources on the web, the members are generally young — 18-30 years old, male, with a college degree, and an entry level salary. And most have modest amounts of cash to invest, originating perhaps from U.S. Treasury stimulus checks, but seek to pyramid this cash into small fortunes.

Classic Examples of Two Meme Stocks in 2021

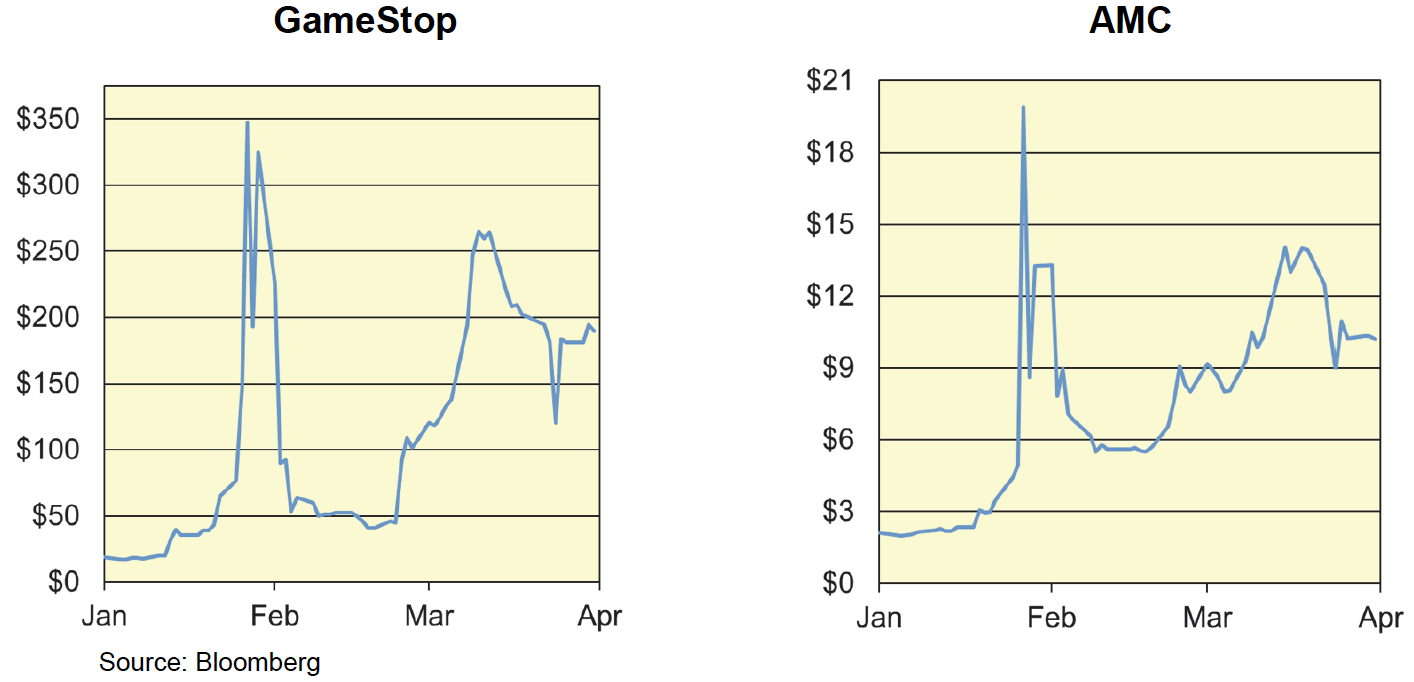

The charts below show the price action of two meme stocks during the first quarter of 2021:

Selling Stocks Short

To understand the price action of GameStop and AMC, it is important to know how short selling works. Short sellers bet that a stock’s price will go down. Essentially, they borrow the stock from their broker, sell it, and if the stock price falls, they buy the stock back at a lower price and return it to the broker, pocketing the difference as a profit. But if the stock price moves up a lot, the short sellers are in trouble. A so-called short squeeze means that not only must short sellers buy the stock at a higher price than what they borrowed and sold it for, but the act of buying back the stock they shorted will also contribute to driving the stock price even higher.

GameStop

As the chart on the previous page shows, GameStop’s stock experienced a parabolic liftoff during the first quarter. GameStop is a largely bricks and mortar retailer of video games and consumer electronics. Even before the pandemic and the lockdowns, it lost money in both 2018 and 2019. With COVID-19 keeping most customers out of their stores, the stock plummeted to less than $3 a share in April, 2020; but with the advent of the vaccines and the promise of the economy reopening, the stock recovered to $20 a share by the beginning of this year. Nevertheless, numerous hedge funds maintained large short positions in the stock in January, 2021. In fact, according to an article in The Wall Street Journal, 175% of the shares available to the public were sold short in mid-January this year. The price action of GameStop between January 13 and January 28 was a classic short squeeze. A handful of well-known hedge funds — Melvin Capital, Citron Research, D1 Capital Partners, and Point72 among others — had huge short positions in GameStop. Traders on the subreddit WallStreetBets noticed the stock was massively shorted, and through their postings and chats, they launched an avalanche of buying of GameStop shares by a vast number of retail investors. According to various sources, these investors also bought large amounts of out of the money call options, which caused the option sellers to buy shares of the underlying stock to reduce their risk. This had the effect of raising GameStop’s stock price even further. As the price rocketed up, it forced the short-selling hedge funds to buy back the stock they had shorted at ever higher prices to cover their losses. The stock peaked at $483 on January 28 — a twenty-four fold increase in price during January. The hedge funds lost billions of dollars. Melvin Capital’s $4.5 billion loss in January was the most publicized one, but the total damage to the short sellers was said to be $13 billion.

AMC Entertainment Holdings

Other meme stocks in the news were Blackberry and Bed Bath & Beyond, but AMC presents us with another clear example of how members of investment subreddits can have a huge influence on the stock price of a company. AMC, which owns 1,000 theaters globally, took on a large debt load in recent years in an effort to consolidate the industry — even as theater attendance began its secular decline. So, AMC’s balance sheet was not in good shape even before the advent of COVID-19. The ensuing lockdowns forced movie theaters to close. Traffic to AMC theaters was down 72% in 2020. AMC warned repeatedly that it was on the brink of bankruptcy if it could not raise funds for operations in 2021 and 2022. AMC’s stock price began 2021 at just over $2 a share, and by January 25, it had climbed to $4.42. Then after the market’s close that day, AMC announced that it had raised $917 million in equity and debt, which would stave off bankruptcy. At the time, the short interest in the stock was 38% — high but nothing like the colossal short position in GameStop. But the “degenerates” on WallStreetBets and other investment subreddits saw their chance. Previously, the average daily trade volume of AMC shares had been around 86 million shares. On January 27, when the stock price topped $20, 1.1 billion shares were traded. A 450% rise in the share price in two days! Once again, the Davids — the populist crowd, had defeated the Goliaths — the Wall Street crowd. The stock trades today around $9 per share.

Echoes of Previous Centuries

The meme stock craze has remarkable parallels with the stock pools of a hundred years ago. During the first third of the 20th century, the legendary stock market “operator” Jesse Livermore (see our October 2015 Quarterly Market Commentary) acquired a well-deserved reputation as one of the most skilled speculators in America. In 1923, Edwin Lefèvre wrote his now famous book, Reminiscences of a Stock Operator — a thinly disguised biography of Livermore and his exploits in the financial markets. The book is an absolute classic and is still considered required reading for professionals in the investment business. The last quarter of the book is devoted to stock pools and the manipulation of the price of securities for the benefit of insiders who were seeking to increase the price of stocks that they wished to unload. At the time, this was completely legal. In essence, a group of investors with a large position in a stock would engage an operator like Jesse Livermore to manipulate a stock through various trading operations to increase the price of the stock. When the operator of the stock pool had successfully caused the price to reach the targeted price level and the volume of trading was adequate, the operator (or “manipulator” as it is called in the book) would sell the shares at or near the target price. Meme stock investing does not appear very different from Livermore’s stock pools.

Around the time of the Civil War, there were even more egregious stock trading operations when the captains of industry attempted to corner some railroad stocks. A corner happens when an investor seeks to gain control over a company, stock, or commodity, to the point where it is possible to manipulate the price. In 1872, Jay Gould attempted the North-western corner, and Commodore Vanderbilt laid his opponents low with his famous corner of the Harlem and Hudson railroads. This is the era when the renowned financier, Daniel Drew, came up with the famous couplet describing the hazards of short selling: He that sells what isn’t his’n, must buy it back or go to pris’n. The most recent attempted corner was when the Hunt brothers tried but failed to corner the world silver market in 1979-1980.

Does It Make Sense to Buy Meme Stocks?

In a word, no. Investing in meme stocks is pure gambling, guided by traders who influence, or perhaps manipulate, large numbers of people who know nothing about the fundamentals of investing. Many, perhaps most, of the millennials getting their marching orders from traders on WallStreetBets, cheerfully acknowledge that they know little about the companies in which they are investing. Last year, meme stock investors bought shares in a company with the ticker ZOOM, thinking that it was Zoom Video Communications (whose ticker is ZM). ZOOM is the ticker of a tiny Chinese phone parts maker, and meme stock investors drove up the price of the stock from $1 to $20 before it retreated to 20 cents. It is probably fair to say that most people who engage in sports betting through DraftKings know more about what they are betting on than many who are trading meme stocks. The phenomenon of meme stock investing smacks of crowd behavior at the end of a long bull market. As this secular bull market, launched in 2009, continues to climb, the watchword for investors is caution. Stick to quality companies and know what you own and why. Do not get caught when the bubble in meme stocks and growth-at-any-price stocks bursts.

Rob serves as chairman of Bradley, Foster & Sargent. He is a portfolio manager and member of the firm’s investment committee and its board of directors.

Rob founded Bradley, Foster & Sargent with Joseph D. Sargent and Timothy H. Foster. Earlier, he was president and CEO of Boston Private Bank & Trust Company, which he founded in 1985, and he spent 14 years with Citicorp, including 12 years in Europe, the Middle East, and Africa. Previously, he served as an officer in the U.S. Navy in Vietnam.

Rob served for seven years on the board of governors of the Investment Adviser Association, the national not-for-profit association founded in 1937 that exclusively represents the interests of federally registered investment advisory firms.

Subscribe

Sign up to receive our latest insights