Sequence Risk: What is it? Why does it matter?

Sometimes, the order in which events occur matters and sometimes it does not. For instance, my daughter holds a rather strong opinion that chocolate syrup should be added to ice cream after the sprinkles and not before. I’m of the opinion that the end result is the same, so what does order matter? In other discussions of sequence, for the most part, we are in agreement. We both know socks should go on before shoes and that we brush our teeth after dinner, but before bed.

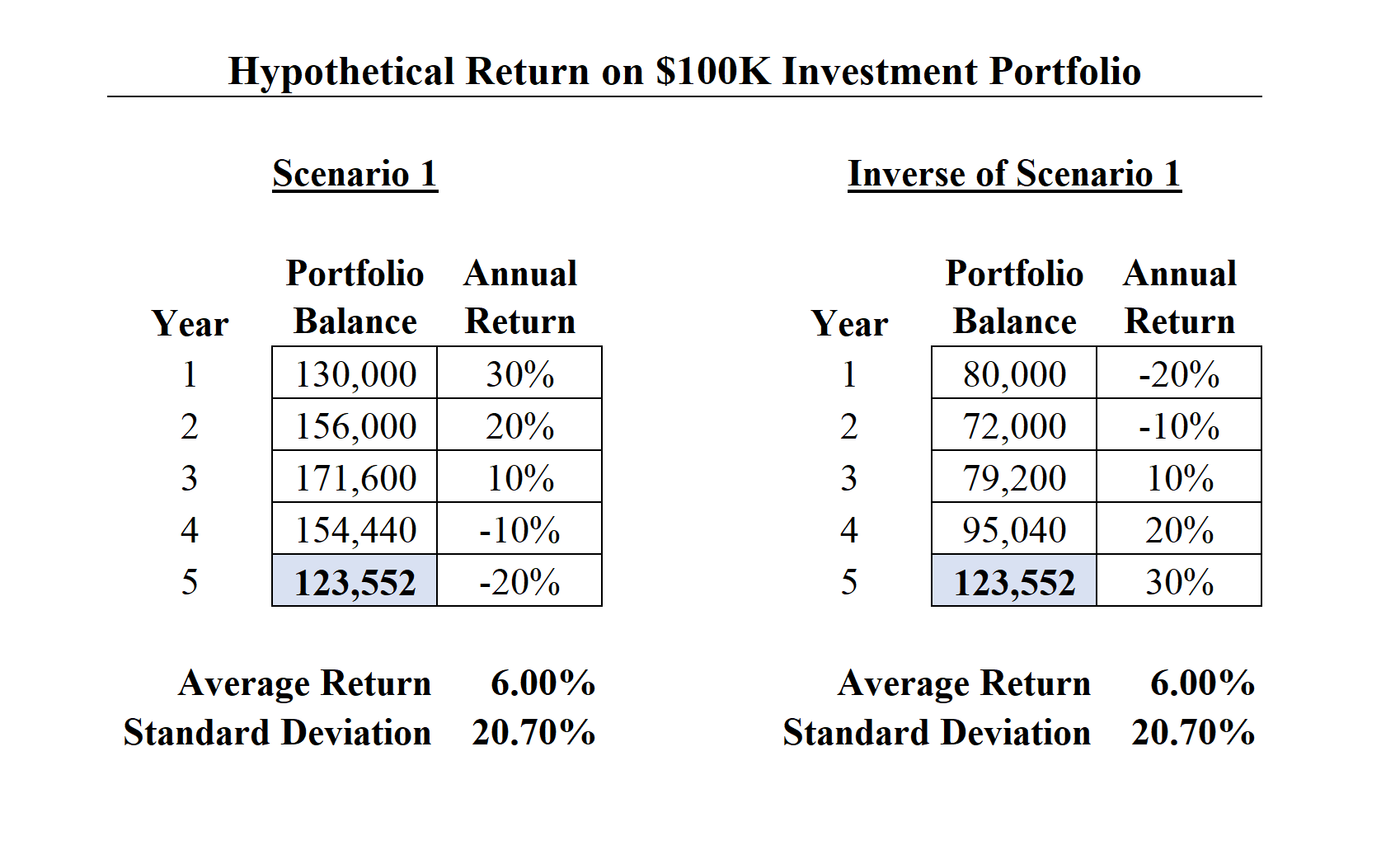

The same holds true for investment returns: Sometimes the order in which returns occur matters greatly and while other times it doesn’t matter at all. When no funds are moving into or out of an investment portfolio, the order of returns is of no importance. Once distributions begin, however, the order in which returns occur can result in significantly different outcomes. In the following example, a hypothetical series of investment returns is compared against the same returns in reverse order:

Notice that the result in both scenarios is the same. Both return sequences lead to the same average return and the same standard deviation. The order of returns does not matter.

When we add an annual distribution, however, things begin to look different. Here, the order of returns matters a lot. When investment accounts are in distribution mode, poor performance in the early years has an outsized impact on the ending investment balance:

The takeaway is that distributions are more costly during down markets than the same distributions taken when markets are up.

What can retirees do to mitigate sequence risk?

For starters, retirees can work with their financial advisor to determine the appropriate asset allocation for their investment portfolios. For portfolios that will be used to fund their retirement cash flow needs, the ideal asset allocation will reduce the likelihood of return volatility while ensuring an appropriate amount of growth to preserve purchasing power throughout the retirement years. Insurance products, such as annuities, appear to be a reasonable choice at first glance because the zero volatility of the income stream removes sequence risk from the equation. However, this strategy comes with a few major drawbacks, including limited protection against inflation and lack of flexibility to meet liquidity needs. Annuities might make sense for a piece of your overall investment strategy, but certainly not for your entire strategy.

Asset allocation decisions vary from person to person. An individual who can cover the majority of their cash needs through Social Security or another form of inflation-adjusted pension will have a different optimal asset allocation compared to an individual who will be more heavily dependent on their investment assets to meet their spending needs. The less dependent a retiree is on their investment assets to fund cash needs, the less concerned they’ll need to be about managing sequence risk. Conversely, the more dependent on their investment portfolios to cover their cash needs, the greater the need to manage this risk.

Developing a diversified investment portfolio to match your specific ability to handle sequence risk can be intimidating but it’s important to get it right. Work with your trusted advisor to design an investment strategy that will help you navigate unpredictable market environments.

Tucker is the director of wealth planning and a portfolio manager. He is responsible for providing in-depth insights into wealth planning and investment management. He provides tailored advice to clients, helping them confidently navigate life’s planned and unplanned events.

Before joining the firm, Tucker was the trust operation director at Clayton Bank and Trust in Knoxville, TN serving wealthy families in east Tennessee. He is a Chartered Financial Analyst® and a Certified Financial Planner™.

Subscribe

Sign up to receive our latest insights